I designed transparency features to solve painful experiences around users' send limits, leading to an increase in revenue and average order value.

A Failure to Communicate Boundaries

I discovered that many users were unclear about how their send limits functioned. They often found themselves needing to send amounts that exceeded these limits. This insight led to a pivotal idea: by enabling users to increase their send limits, we could simultaneously boost our revenue.

"When my dad was hospitalized with Covid in India, Ria's send limits couldn't cover urgent bills. I had to use another provider which took a long time during a stressful period" - Arjun

"No. I'm still confused, was it a per day limit or per month? Or if it was $3,000 or something I'm not aware yet??" - Pooja

"I have requested by email and by phone, but no one has given me an increased limit. But with Xoom in one day I can send $20,000." - Kai

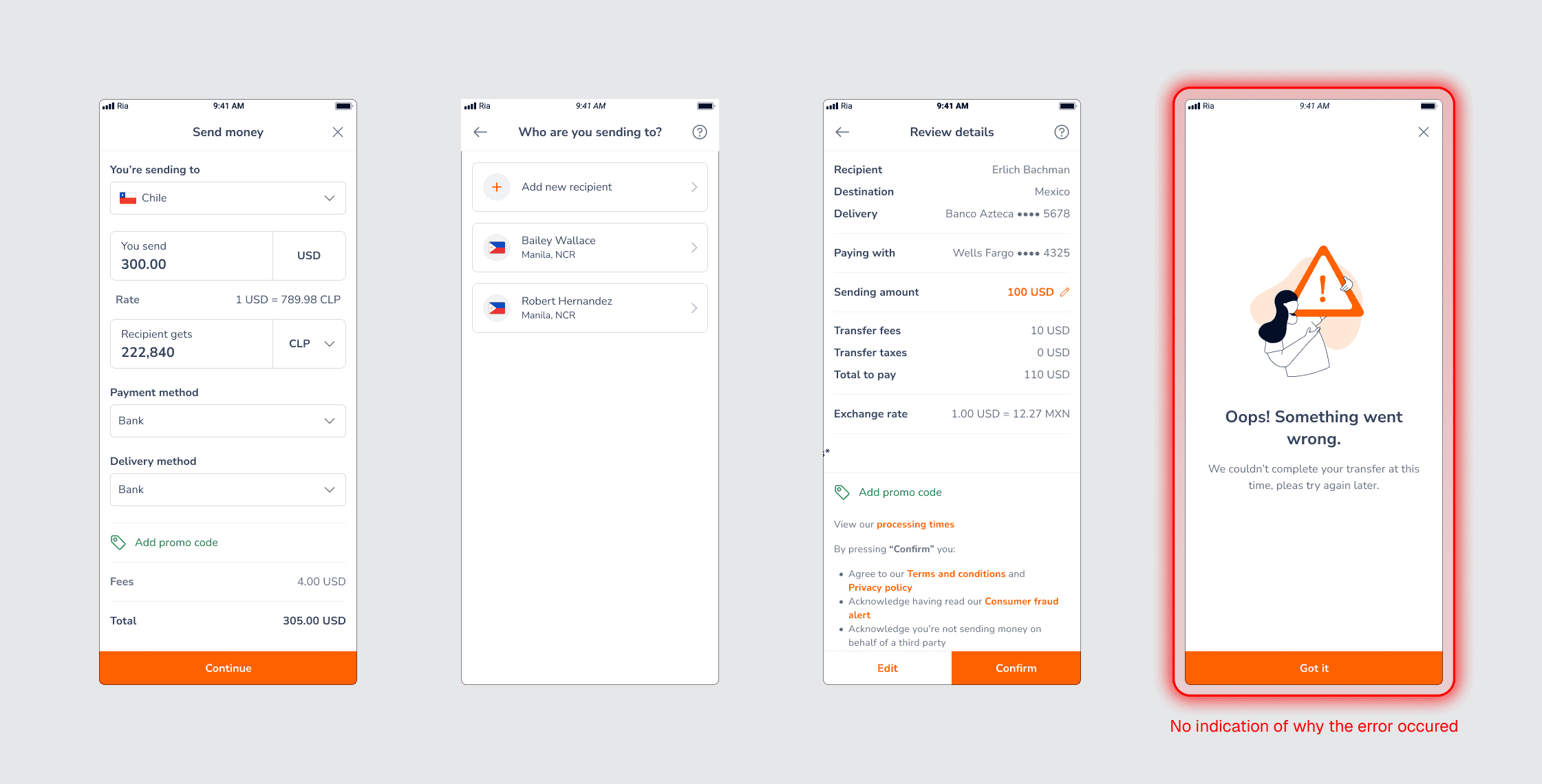

Users wanted to send more money through Ria, but we weren't letting them. Not only were we making their lives more difficult, we were also leaving money on the table. However, there was a very good reason for this, the compliance risks involved in increasing user limits were significant. We had to convince compliance and legal it was worth the risk.

Making a business case for increasing send limits

Our most significant challenge in validating our hypothesis with stakeholders was demonstrating that the potential revenue increase would justify the compliance costs. Our analysis revealed that Ria rejects approximately 50,000 transactions annually for exceeding the send limit.

By addressing this issue, we projected a potential revenue increase of 5% to 10%, and got the green light to make the business rule change and design new transparency features

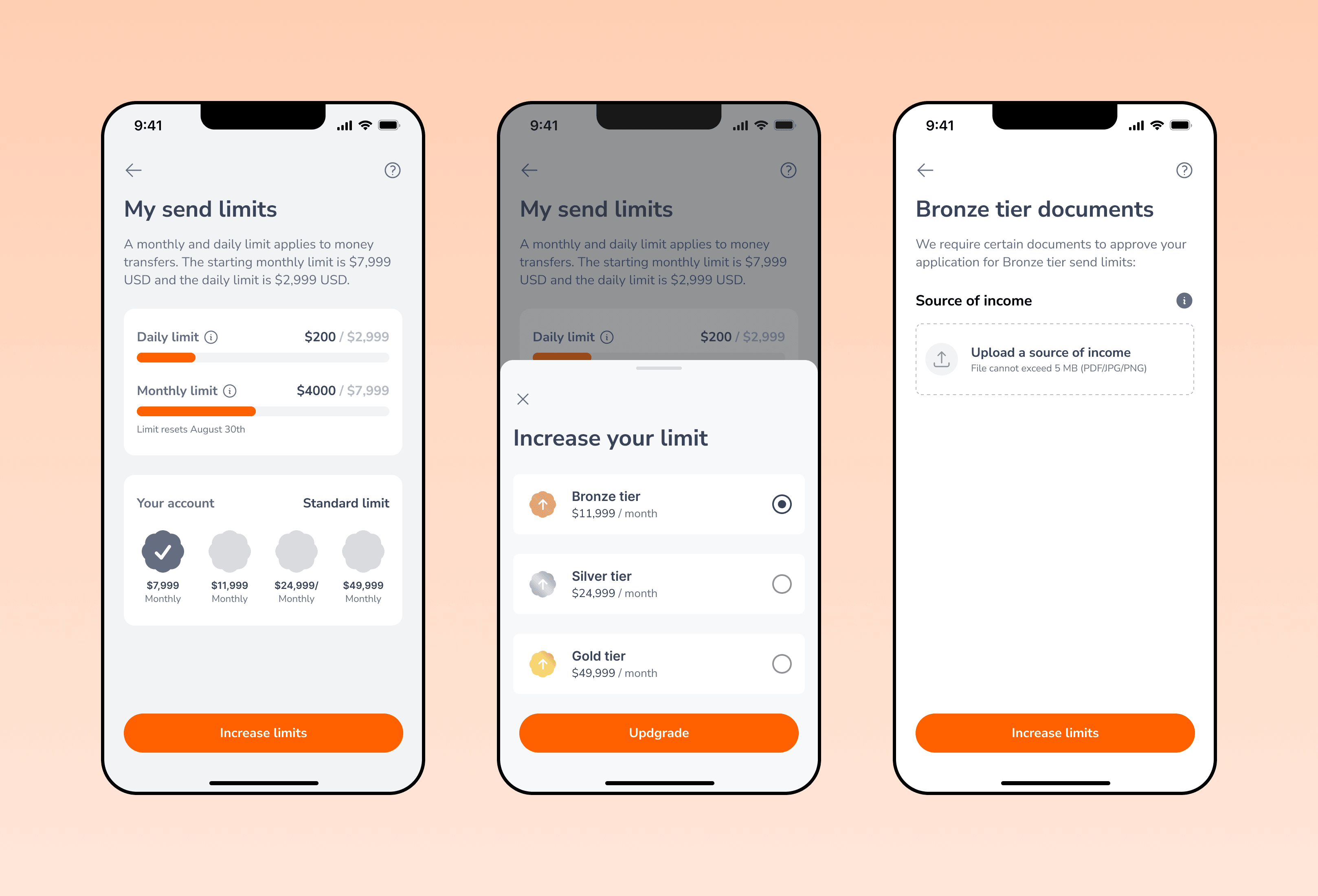

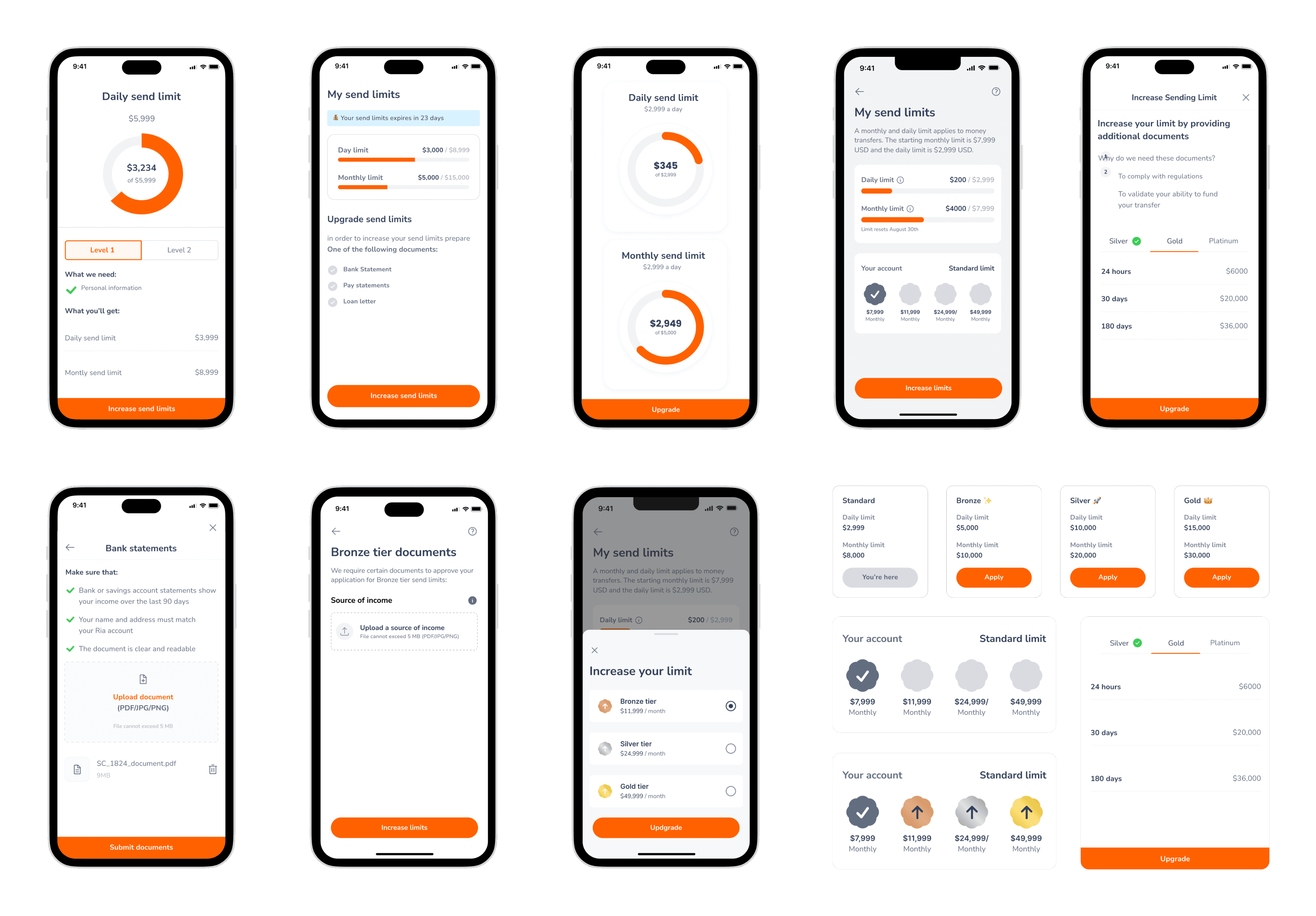

Explaining limits to users

A primary challenge for our users was a lack of understanding regarding the difference between daily and monthly limits, as well as the reset schedule for their monthly limit. To address this confusion, we investigated several methods of improving how we communicate this crucial information.

The importance of alignment across business groups

This feature provided a valuable lesson in navigating the complexities of the financial sector, where compliance reigns supreme. Engaging stakeholders required considerable effort due to the regulatory focus. For future initiatives, collaborating closely with business analysts will be crucial. Their expertise in crafting compelling analyses and profit projections is essential to influence stakeholders and ultimately enhance user experience.

Our initial focus was the launch of a send limit increase trial for customers transferring funds from the US to India. This experiment yielded positive outcomes, notably enhancing both the revenue and the principal amount per transaction.